Urklang, think of it like this:

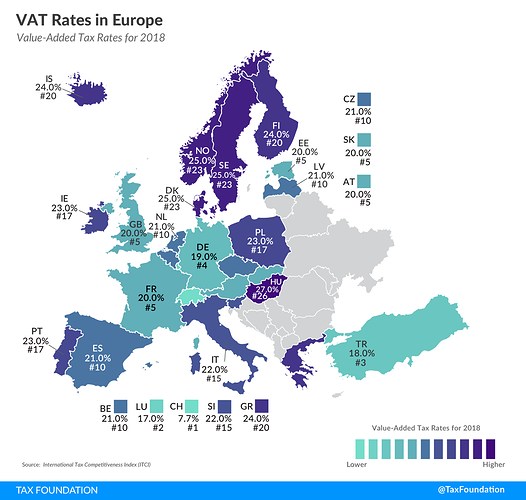

You first of all decide the price of your product. The amount of VAT you need to charge is dependent upon where the customer is. So, for example, if your board was priced at $100 US Dollars, what would happen if I ordered the board from here in the UK is your website would auto-detect that as the order is being delivered to the UK, that 20% would need adding to the total.

Now if, for example, you charged $10 for shipping to the UK, the total cost would be:

$100 Axoloti board

$10 Delivery

= $110 + 20% VAT due to the VAT rate set for the UK

= $132 Total

Note that exchange rates will be handled by your website software and are irrelevant to you. Another thing that is irrelevant is any import taxes due when it reaches the UK. Usually, you as the seller simply would state that import taxes are not included and are the responsibility of the buyer.

Now here's the thing, something that might have been confusing you. Let's say that your product was available in Europe, through a seller like thonk.co.uk. There are two benefits to it, the first being that you could ship-off in bulk to them, and they in turn do the work of selling and shipping to everyone in the EU.

The other benefit is that because the customer is buying from within the EU, they will not be charged any import tax. Basically, anyone living in any EU country could order from thonk.co.uk and there would be no import tax to pay, because technically both the buyer and seller are located in the EU. That's what the EU is, it's an import-tax-free trading block.

Note though, that I said import tax free, not VAT free

No doubt there are errors in what I explained, but that's pretty much it just as long as you remember that each EU country is free to set it's own VAT rate, and as a result, your website must auto-detect and charge according to delivery address.